Abstract

Water markets have the potential to lessen some costs of climate change. However, they need to be designed to address the unique institutional and physical features of water. In this Perspective, we discuss the role water markets could play in adapting to climate change and outline opportunities for moving forward. We draw on the environmental economics literature to highlight past challenges with water markets and environmental markets more generally, and identify opportunities for water-specific market design. We argue that water markets will serve to improve adaptation if they are designed with these key features in mind.

Similar content being viewed by others

Main

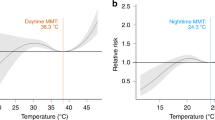

Global climate change models indicate a systematic reconfiguration of water resources. Droughts and floods will become more frequent and extreme; interannual fluctuations in precipitation will increase; and the spatial distribution of precipitation will change1. Markets that enable water trading across locations and over time would allocate water to higher use values, and in doing so dampen the costs of extreme weather events and increased volatility in precipitation. Warming temperatures will also directly impact the supply of and demand for water resources. They will alter the medium and timing of water supplies and, in some locations, increase evaporation and reduce soil moisture2. All else equal, warmer temperatures will increase demand for groundwater resources. Groundwater markets that assign well-defined property rights, establish an appropriate cap on total extraction and allow for trading can improve the allocation of this scarce resource over time, and reduce the costs of climate change.

Environmental markets have grown in scale and scope as a tool to protect natural resources and the environment. Cap-and-trade programmes regulate CO2 emissions in more than 31 jurisdictions, including the European Union and China, and carbon pricing has been proposed or implemented in over 30 locations3,4,5. Markets for environmental goods have also been introduced to manage about 5% of global fisheries, abate local air pollution and improve water quality6,7,8,9,10. However, they have largely been absent in the management of global water resources.

A market for water describes the voluntary, compensated transfer of water or water rights. With a market, the price and quantity of water purchased and sold are determined by the interaction of demand and supply. Under this decentralized system, buyers differ in their willingness to pay for a unit of a water and sellers vary in their willingness to accept to provide an additional unit of the good. It is the intersection of aggregate demand and supply in this exchange economy that determines the equilibrium or market price and quantity of water. The theoretical appeal of markets is that the net benefit to society from the allocation of water is maximized at this equilibrium. Market-based approaches can be deployed to achieve sustainable groundwater levels, allow the reallocation of surface water across users with disparate rights and values, and concurrently manage groundwater and surface water.

Markets may reduce existing distortions in the current allocation of water. One inefficiency arises because the institutional and regulatory landscape that guides the allocation of water often limits the scope for water trading or renders it economically inviable11,12. This leads to limited trading in many surface water settings, including those where well-defined property rights exist. Water markets that allow trading and reduce the legal, institutional and regulatory costs involved in these trades would reallocate water from those who value it less to those who value it more13.

A second inefficiency may occur because some of the costs involved with water consumption are not priced. This is particularly acute with groundwater, since individual extraction may increase neighbours’ pumping costs, degrade water quality and reduce future water supplies. Externalities arise when these direct and unintentional costs of water withdrawals go uncompensated or are not priced into the market. Environmental markets introduce a price for a previously unpriced good and can achieve a policy goal at the lowest cost. Pricing water to reflect the marginal private and external costs of supply will ensure that all users account for these costs when making decisions about water use.

The effective implementation of markets is predicated on a number of key characteristics—well-defined property rights for the good, low transaction costs, a sufficient number of buyers and sellers, complete information, and monitoring and enforcement of the market—that are often missing or compromised in the water setting14. As an example, leakage, a phenomenon in which emissions reductions in regulated locations are simply offset by increases in unregulated jurisdictions, may occur if users rely on both surface and groundwater, and water use is not monitored15. Markets must also be designed to account for the hydrological and physical properties of water. Undifferentiated permits that assign the same value to each unit of water conservation—regardless of where it is achieved—will fail to incorporate spatial differences in the damages of groundwater extraction16. At the same time, local markets that incorporate these differences by remaining small in scale run the risk of being too thin17. While this Perspective highlights several lessons for the design of water markets, our discussion of them is not exhaustive. In particular, we do not discuss the political economic forces that determine water policy.

Many of the challenges and obstacles confronted in the design of effective water markets are not unique to market-based approaches. While some hurdles—such as the need for groundwater trading rules that prevent localized depletion—are specific to markets, many are often encountered in the design and implementation of any policy to manage water resources. Leakage, distributional impacts and enforcement offer examples of concerns that span both market and non-market approaches. Fortunately, solutions exist to address many of the physical, regulatory and institutional features that could hinder the design and implementation of effective water markets. Water markets provide a promising tool to adapt to climate change-induced increases in water scarcity and water volatility, but they must be intentional in accounting for the specific institutional and physical features of the water setting.

Water allocations and climate change

Natural and human forces have shaped the global allocation of water resources. Freshwater supplies come from two main sources: groundwater and surface water, which includes river water, snow melt and rain. Agriculture is the dominant user of water, accounting for over 70% of consumptive freshwater use globally18. Domestic and commercial users represent approximately 11% and 19% of water withdrawals, respectively, and often display the highest willingness to pay for water19. These global statistics, however, mask substantial geographic and temporal differences in the allocation of water resources. As an example, agricultural water withdrawals account for 90% of withdrawals in low-income countries but only 41% in high-income countries19. The institutions that govern water, infrastructure that transports water and the projected impacts of climate change on water resources also display substantial spatial and temporal variability.

For the approximately 80% of global cropland that relies exclusively on rainfed agriculture, demand and supply are determined by local seasonal precipitation. In China, Australia and the western United States, a complex and vast infrastructure of damns, canals, pipelines, reservoirs and rivers moves and stores surface water. This allows water to move from water-abundant to water-starved regions, and to be stored when it is plentiful and withdrawn when it is scarce. This conveyance and storage network also makes it technologically feasible to trade surface water among users, moving water across farms or between farms and cities. In these locations, the reallocation of water from those who value it less to those who value it more can reduce inefficiencies13. However, legal and institutional barriers often prohibit or limit trade, and the status quo is for users to consume water according to fixed water rights based on historical precedent20. In settings where trading is both physically and legally viable, the costs associated with the governance of property rights and trades may outweigh the gains21. Inefficiencies in the allocation of surface water may arise because of limited infrastructure, non-transferable property rights, and regulatory and information costs.

Globally, groundwater irrigation accounts for 40% of irrigated agriculture, with many of the most productive agricultural regions overlying aquifers22. However, many of these aquifers are under stress with rapid depletion occurring in one-third of the world’s largest aquifers23. Overextraction arises because of the absence of well-defined property rights to manage groundwater resources24. In basins with poorly defined property rights, users are not limited in how much groundwater they extract. Because of the non-excludability of this rival resource, users do not account for the costs they impose on others. These societal costs—referred to as negative externalities—include increased pumping costs for neighbours due to a lower water table, a reduction in supplies available for future users and compromised water quality25,26,27,28,29. Well-defined and tradeable property rights could rectify these externalities through bargaining and negotiation, but only if bargaining costs are low24,30,31,32,33,34. If the numbers of users are large and the costs of negotiation sizable, other interventions such as market-based approaches may be needed to achieve the optimal path for groundwater extraction.

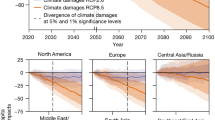

Global climate change models indicate meaningful changes to water resources, with worsening water stress in already drought-prone regions (Fig. 1). When coupled with the current institutions used to manage surface and groundwater, existing inefficiencies in surface water and groundwater could be exacerbated under climate change. Climate change models project more frequent and extreme droughts and floods, increased variability in precipitation and changes in where precipitation occurs1,2. This translates into increased fluctuations in interannual surface water supplies, and probably increased costs from the absence of transferable surface water rights35. Warming temperatures will also directly impact water resources through the channels of supply and demand. Heat increases evaporation and shifts precipitation regimes from snow to rain, which challenges the management of reservoir systems for storage36,37. Warmer temperatures are also projected to increase evaporative demand (or atmospheric thirst) and reduce soil moisture in drier locations, leading farmers to irrigate in response to heat2,38. Given fixed quantities of surface supplies, this increase will largely come from groundwater resources. This additional reliance on groundwater will exacerbate the external costs of pumping attributable to the open-access nature of the resource. The changing water landscape under climate change provides both challenges and opportunities for the potential and design of surface and groundwater markets.

The projected exposure is calculated as the ratio of projected withdrawals (across all sectors: municipal, industrial and agricultural) to projected supplies and is based on data from the IPCC Fifth Assessment Report. These ‘cautiously optimistic’ projections combine RCP 4.5 emissions and temperature projections with SSP 2 ‘business-as-usual’ scenarios of socio-economic drivers of water use92. Projection data from the World Resources Institute93.

Surface water markets

Voluntary surface water trading that allows the purchase, sale or lease of water across users provides an opportunity to correct existing inefficiencies in the current allocation of surface water and reduce the costs of climate change-induced water supply disruptions. Residential, agricultural or environmental users may value it more than those endowed with historical surface water rights. Surface water markets would reallocate water from lower marginal value to higher marginal value uses, reducing existing allocative inefficiencies. They may also aid in climate change adaptation. Markets that allow trading of water across locations and over time may lessen the costs of increased volatility in precipitation, droughts and floods.

Our experience with surface water markets thus far is limited, with isolated markets arising in the western United States, Chile, Spain, Argentina, China, South Africa and Australia. In Chile, surface water trading is generally permitted, leading to regular trades—especially in the northern regions where surface water infrastructure is well-developed. In these areas, a pattern of transfers from agriculture to copper mines arose until recently, when mines were prohibited from purchasing rights39. California (United States) allows case-by-case surface water trading across cities and irrigation districts, between cities and environmental users, and between irrigation districts40. As discussed in Box 1, Australia has a rich surface water market concentrated in the Murray–Darling Basin that has been estimated to generate AU$172 million per year in benefits41. This market has evolved over time to better protect the environment and address other design challenges42,43. China recently established a broad surface water market and a national water exchange to facilitate trading in what has been a relatively thin market44. These market experiences point to the following challenges and opportunities involved in the design and implementation of surface water markets.

Transaction costs

High transaction costs are a defining feature of surface water markets, and operate as a barrier to otherwise beneficial water transfers. Physical limitations can prevent trading because the physical costs to move and reallocate water may exceed the gains from trade. Water rich and scarce regions are not always naturally interconnected, and infrastructure may not be in place to move water across regions. Even with infrastructure in place, substantial conveyance costs in the form of fees, legal obstacles or evaporative losses are frequently involved in the physical movement of water across long distances45. These costs may increase with climate change-induced changes in hydrology, as interannual volatility in precipitation grows and precipitation regimes shift46.

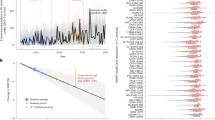

Although physical transaction costs are difficult to address, policy solutions exist to mitigate search and regulatory-induced transaction costs. In the absence of a central clearing house, substantial time and effort accrue in the search for a trading partner and the negotiation over the price, quantity and timing of the transfer. In California, the surface water market lacks a mechanism for matching buyers and sellers. This may partly explain why transactions in the state are thin, representing just 4% of all water used in the state40. It also may partly reconcile the disparity in trading activity between water transfers in California and Australia. Farmers in Australia reported that the existence of a water exchange for water transfers substantially reduced information acquisition and search costs, and encouraged market participation47. The establishment of a centralized platform for interested buyers and sellers to submit bids and a coordinator to facilitate matches would reduce transaction costs and augment trading.

The administrative costs of obtaining regulatory approval and creating enforceable contracts act as another impediment to water trading. In the western United States, even when parties have agreed to the sale of water and physical infrastructure permits its movement, costly water laws and regulatory approvals often prevent or delay trading48. In Colorado, legal costs account for up to one-third of the cost of water transactions49. Excluding search and contracting costs, transaction costs in California’s surface water market represent US$107 per acre-foot, a large share of the average observed price of US$221 (ref. 21). In the case of the southern Murray–Darling Basin in Australia, regulatory hurdles differ between permanent trades and temporary leases50. Transaction costs may also vary by the type of water right, with appropriative rights often carrying higher transaction costs than others51. Regulatory oversight is critical in the effective implementation of water markets as in its absence, externalities and public goods will not be reflected in trading behaviour. However, regulatory transaction costs could be meaningfully reduced. A tax that directly prices the negative external costs of a transaction will probably offer a least-cost instrument to address these externalities. In the absence of a tax, efforts to streamline and remove unnecessary regulatory and political obstacles from the currently lengthy, bureaucratic and fragmented processes would increase the benefits of trading52.

Externalities and distributional effects

A key feature of water trading is that the movement of the resource to other regions can impose unintentional and direct costs on the communities and users reliant on surface water supplies. Market transfers of water that reduce supplies of water flows may degrade water quality and supplies for other users, compromise water-dependent ecosystems or introduce human health costs. In 2003, the largest agriculture-to-urban water transfer in US history occurred when the Imperial Irrigation District in Southern California agreed to sell Colorado River water to San Diego County. Despite designs to prevent degradation of the Salton Sea, these transfers reduced inflow to this saline lake, and the drying of the lake increased dust-related air pollutants53,54. When third-party costs attributable to transfers are not included in market trades, it results in trading quantities that are too high and trading prices that are too low. To ensure that surface water markets improve social welfare, water prices must incorporate the external costs involved with trades.

Water markets will also lead to a redistribution of benefits and costs across users and communities. First, trading activity may impose costs on some users if it alters market prices through changes in agricultural wages or crop prices. However, these price effects are not unique to markets, and will arise under any policy instrument. Rural communities and economies may be particularly vulnerable to water markets if the sale of agricultural water to municipalities induces a contraction in irrigated acreage, farm employment and tax revenues55. In response to these concerns, some irrigation districts have earmarked revenues from the sale of water, using these funds for community development and job training56. A key challenge in the management of water resources, including market design, is how to address the potential redistribution of costs to local communities.

Incomplete regulation and leakage

Incomplete regulation may limit the benefits of market-based instruments. Incomplete regulation occurs when the regulation only applies to a subset of water resources or water-consuming entities, and may arise for political, technical or institutional reasons57. In California, one reason why water trading is incomplete is because trading occurs almost exclusively within water projects and rarely across them. This fragmentation arises because water projects may not be physically connected, but also occurs because of regulatory rules. These barriers prevent otherwise beneficial trades from occurring and limit the efficiency gains from markets. Markets must account for externalities involved with trading, but many of the current rules that prevent and guide trade lead to a fragmented and incomplete market.

The separate management of surface water and groundwater, despite their interconnectedness and near perfect substitutability, compromises the effectiveness of regulations to manage surface water58. Traditionally, groundwater and surface water have been regulated by separate institutions with the rules governing one sector inapplicable to the other. As a result, surface water conservation measures may simply be offset by increases in groundwater extraction. This leakage describes an increase in groundwater extraction—an unregulated sector—that occurs as a direct result of incomplete regulation. Leakage has received considerable attention in carbon markets as GHG regulations that apply only to emissions in a certain location may be partially or completely offset by increases in unregulated locations15,59. Surface water trading may be particularly susceptible to leakage as sellers may compensate for reductions in surface water use simply through increased groundwater pumping. This has led to the imposition of groundwater export restrictions in some counties in California60.

Conjunctive management has been demonstrated in markets through the regulation of local air pollution in Southern California’s NOx Trading Program. The programme established a cap-and-trade system for large facilities, and this market-based approach reduced emissions by 20% relative to a command-and-control regulation7. The management of small firms using a command-and-control regulation ensured that reductions in emissions at large facilities were not offset by commensurate increases at smaller facilities. The joint management of large and small firms addressed leakage, while allowing the cap-and-trade programme to achieve environmental goals at reduced cost61. Policy instruments that conjunctively manage surface and groundwater may prevent leakage and increase the gains from water markets62.

Groundwater markets

Markets that manage groundwater may remedy existing external costs from groundwater extraction and serve as a tool to mitigate the costs of climate change. In the absence of well-defined property rights, groundwater users do not internalize the costs their behaviour imposes on others. Setting a sustainable cap on total extraction and pricing groundwater to reflect the marginal social cost of supply would correct for these inefficiencies. This could be achieved through a well-designed water market.

Cap-and-trade programmes may also provide a low-cost option to ensure the long-term availability of groundwater as a buffer to drought and surface water volatility. Caps on allowable groundwater extraction can be used to achieve sustainable groundwater levels, and trade enables the optimal distribution of water conservation among users exposed to the cap. The appeal of incentive-based approaches over uniform mandates or quotas is that, in theory, they achieve these targets in the least-cost way. This is because trading among users allows flexibility in how much each user conserves and the strategies employed to achieve conservation. As warming temperatures and extreme droughts lead to increased reliance on groundwater, the dynamic efficiency gains that could be achieved by managing aggregate groundwater use become greater. Achieving long-term sustainability cost effectively is key to reducing the costs of climate change.

Despite their potential, market-based approaches to manage groundwater rarely occur in practice. Simulations point to substantial gains from the introduction or augmentation of groundwater trading in Australia and parts of the United States.63,64,65,66,67,68. However, with few exceptions, these have yet to translate to the field. One such example, detailed in Box 2, is the establishment of a cap-and-trade system for groundwater in the Mojave Basin of Southern California. Volumetric groundwater pricing has also been rolled out in a few groundwater basins in the western United States and piloted using volumetric electricity pricing in Gujarat, India, and water pricing in Bangladesh68,69,70,71,72. An overarching challenge in the effective deployment and scaling of groundwater markets is that they must be designed to accommodate specific nuances and features of the groundwater setting. Failure to account for these characteristics could erode the potential for groundwater markets to serve as a climate adaption tool.

Monitoring and enforcement

Monitoring and penalties for non-compliance are important components of successful markets for air pollution, including the EU Emissions Trading System and California’s carbon market5,73. A pragmatic limitation on the implementation of water markets is that agricultural groundwater extraction is rarely metered20. This makes it challenging to directly monitor groundwater withdrawals. To circumvent this issue, regulators often proxy for groundwater withdrawals. However, proxies are susceptible to measurement error and often lack the granularity needed for the enforcement and monitoring of markets74. Technological barriers do not seem to constrain the deployment of meters. Residential water use is metered and priced in many cities in countries that are members of the Organisation for Economic Co-operation and Development. Expanding water meters to the agricultural groundwater sector, or deploying alternative technologies that estimate field-level groundwater use, is a first and critical step towards groundwater management.

Conditional on measurement, effective markets require that the rules governing water markets are enforced. In Australia’s Murray–Darling Basin surface water market, meaningful gaps in the enforcement of surface water diversions have been a persistent issue75. While government audits highlight effective governance in many jurisdictions, they point out that in some locations substantial flaws exist in the monitoring and enforcement of diversions. The absence of costly penalties for non-compliance or the non-enforcement of these penalties may undermine the performance of water markets.

Heterogeneous damages

Non-uniform damages characterize groundwater extraction, and effective market-based approaches must be designed with this in mind. In some settings, such as for CO2 emissions, the marginal damage from an additional unit of emissions is the same across all emitters. This is because CO2 is a global pollutant, so the external cost of an additional tonne of carbon emissions does not depend on the location of emissions. The implication of this is that trading can occur on a one-for-one basis. With groundwater, this is not the case. For example, the ecological impact of an acre-foot of extraction on stream flow and fish will depend on the proximity of groundwater extraction relative to streams. Similarly, the cost imposed by changes in water quality, land subsidence and depth to the groundwater table will also vary across locations. Market-based approaches that do not account for this heterogeneity in marginal damages will be inefficient.

Spatially differentiated trading ratios or groundwater prices that reflect the non-uniformity of damages from extraction may improve market performance. The exchange rate of these ratios will depend on the hydrologic, climatic, environmental and agronomic characteristics of an area. In some regions, such as Nebraska, United States, the underlying physical characteristics of the aquifer may render an undifferentiated permit system cost effective64. However, under more stringent conservation targets or environmental protection policies, spatially differentiated trading ratios may deliver substantial cost savings64. Trading ratios and differentiated pricing offer a first step in improving the design of groundwater markets, but should be developed with pragmatics in mind15,16,76. Policies that try to incorporate all the complexities in the mixing and movement of groundwater may lead to markets that are too thin or costly to administer.

Geographic domain

A key consideration in market design and implementation is how to determine the relevant size and geographic boundaries of a groundwater market77. Hydrogeological boundaries that create disconnected groundwater basins could serve as boundaries to delineate markets. The advantage of restricting a market to a physical groundwater basin is that social costs introduced from the movement of water across basins will be avoided. However, restricting a market to a physical groundwater basin may undermine the cost effectiveness of the market, as a limited number of agents will operate in the market17. One explanation for thin trading in water pollution markets is that permit trading is restricted to watershed boundaries, limiting the scope of potential market participants78. While markets must be designed to account for differences across groundwater basins, reduced liquidity from highly localized markets may hinder the ability of markets to function properly.

California’s Sustainable Groundwater Management Act (SGMA) offers up a live example of the strengths and weaknesses of restricting the market to a physical groundwater basin. SGMA requires groundwater agencies to formulate and implement plans to reach and maintain sustainable groundwater levels, with each effectively operating as its own entity or market. Over 100 groundwater sustainability plans have been submitted, and over one-third of those are considering setting individual pumping limits and allowing trade79. A look at the market liquidity, the gains from trade and the consequences for third parties in these localized markets will reveal the trade-offs associated with market fragmentation. There may be opportunities for neighbouring basins to coordinate trading programmes to increase liquidity, particularly when basin boundaries are administrative and not of hydrologic significance.

Assignment of property rights

Property rights for water can be allocated in many ways. They can be auctioned off, determined by a political process or assigned on the basis of historical use, land ownership or a ‘reverse grandfathering’ allocation rule80. A key theoretical insight in environmental markets is that, if the market is competitive, the initial distribution of property rights should not affect cost effectiveness17,81. In reality, most markets suffer from imperfections. Evidence suggests that market participants with outsized political influence have influenced water reform initiatives in the Southern Murray–Darling Basin of Australia, hindering the ability of regulators to correct market imperfections82. In the presence of pre-existing market distortions, the decision on how to allocate permits, as well as how to spend auction revenues, impacts the policy costs of markets83.

The allocation of property rights will also influence the distribution of rents from the sale or purchase of extraction permits. Distributional considerations partly explain resistance to the introduction of groundwater markets in California and India69,84. They have also led to challenges in the implementation of existing surface water markets. In Chile and Australia, the initial allocation of property rights has created concerns about the acquisition of water rights by mining companies and the perpetuation of existing inequities among Indigenous groups, respectively85,86. Moving forward, markets—and in particular the assignment of property rights—should be designed with efficiency and distributional implications in mind.

Moving markets forward

Climate change is likely to alter the underlying quantity, distribution and variability of water resources in ways that will exacerbate existing allocative inefficiencies in the current allocation of water resources, expanding the potential benefits of trade. Well-designed water markets offer a promising tool to lessen the costs of climate change and achieve an array of environmental, societal and economic objectives. However, our experience with markets is limited. Gaps in the current state of knowledge point to three avenues for moving markets forward.

First, a clear research need arises to learn about the potential of markets to reduce costs from a changing water landscape. Where evidence on water markets does exist, the focus has been on the realized gains of surface water trading to reduce current inefficiencies. A sparse literature has indirectly considered the role of markets as a tool to cope with a changing water landscape by assessing the gains from trade in response to water supply curtailments or drought21,65,68,87,88. Understanding how markets perform in response to a range of climate change-induced water supply disruptions will provide much needed information on their ability to mitigate the costs of climate change.

Second, past experiences with water markets should be viewed as critical inputs and learning blocks in the design of future markets. The first cap-and-trade market under California’s SGMA occurred in Fox Canyon. Despite a thoughtful and thorough design process, it has encountered multiple challenges in its implementation89. Market design will be an iterative process, and lessons learned from early experiences may transfer to other settings. For example, experiences in the Murray–Darling Basin highlight trade-offs between reserving water for the environment and allowing more water to be available for trade among irrigators75. Research on the performance and challenges of markets in early adopter scenarios, and the sharing of this information, is critical to effectively realizing the theoretical benefits of markets in practice.

Lastly, lessons learned from the deployment of environmental markets in other settings may provide valuable insights for the implementation of water markets. Markets have been deployed to manage fisheries, water quality, local air pollutants and GHG emissions. While water differs from these markets in some key ways, we can learn from the implementation and design flaws of environmental markets in other contexts. As examples, policies to address leakage in CO2 markets, differentiated damages in water quality markets or trade-offs between distributional and efficiency objectives in fishery markets may serve as a starting point to address these concerns in the water context90,91. As we inch forwards with water markets, lessons gleaned from other environmental markets may aid in their design and implementation.

References

Swain, D. L., Langenbrunner, B., Neelin, J. D. & Hall, A. Increasing precipitation volatility in twenty-first-century California. Nat. Clim. Change 8, 427–433 (2018).

Arias, P. et al. in Climate Change 2021: The Physical Science Basis (eds Masson-Delmotte, V. et al.) 33–144 (IPCC, Cambridge Univ. Press, 2021).

State and Trends of Carbon Pricing 2020 (The World Bank, 2020).

Nogrady, B. et al. China launches world’s largest carbon market: but is it ambitious enough? Nature 595, 637 (2021).

Colmer, J., Martin, R., Muûls, M. & Wagner, U. J. Does pricing carbon mitigate climate change? Firm-level evidence from the European Union Emissions Trading Scheme. SSRN https://ssrn.com/abstract=4026889 (2023).

Costello, C., Gaines, S. D. & Lynham, J. Can catch shares prevent fisheries collapse? Science 321, 1678–1681 (2008).

Fowlie, M., Holland, S. P. & Mansur, E. T. What do emissions markets deliver and to whom? Evidence from Southern California’s NOx trading program. Am. Econ. Rev. 102, 965–993 (2012).

Shortle, J. & Horan, R. D. Policy instruments for water quality protection. Annu. Rev. Resour. Econ. 5, 111–138 (2013).

Deschenes, O., Greenstone, M. & Shapiro, J. S. Defensive investments and the demand for air quality: evidence from the NOx budget program. Am. Econ. Rev. 107, 2958–2989 (2017).

Aldy, J. E., Auffhammer, M., Cropper, M., Fraas, A. & Morgenstern, R. Looking back at 50 years of the Clean Air Act. J. Econ. Lit. 60, 179–232 (2022).

Archibald, S. O. & Renwick, M. E. in Markets for Water: Potential and Performance (eds Easter, K. W. et al.) 95–117 (Springer, 1998).

Garrick, D. & Aylward, B. Transaction costs and institutional performance in market-based environmental water allocation. Land Econ. 88, 536–560 (2012).

Libecap, G. D. in New Institutional Economics: A Guidebook (eds Brousseau, E. & Glachant, J.-M.) 272–291 (Cambridge Univ. Press, 2008).

Wheeler, S. A. Water Markets: A Global Assessment (Edward Elgar, 2021).

Fowlie, M. & Reguant, M. Challenges in the measurement of leakage risk. Am. Econ. Assoc. Papers Proc. 108, 124–29 (2018).

Muller, N. Z. & Mendelsohn, R. Efficient pollution regulation: getting the prices right. Am. Econ. Rev. 99, 1714–39 (2009).

Baumol, W. J. & Oates, W. The Theory of Environmental Policy (Cambridge Univ. Press, 1988).

Faurès, J.-M., Hoogeveen, J. & Bruinsma, J. The FAO Irrigated Area Forecast for 2030 (FAO, 2002).

Ritchie, H. & Roser, M. Water use and stress. Our World in Data https://ourworldindata.org/water-use-stress (2017).

Molle, F. Water scarcity, prices and quotas: a review of evidence on irrigation volumetric pricing. Irrig. Drain. Syst. 23, 43–58 (2009).

Hagerty, N. What holds back water markets? Transaction costs and the gains from trade. https://hagertynw.github.io/webfiles/Liquid_Constrained_in_California.pdf (2023).

Siebert, S. et al. Groundwater use for irrigation–a global inventory. Hydrol. Earth Syst. Sci. 14, 1863–1880 (2010).

Richey, A. S. et al. Quantifying renewable groundwater stress with grace. Water Resour. Res. 51, 5217–5238 (2015).

Coase, R. H. in Classic Papers in Natural Resource Economics (ed. Gopalakrishnan, C.) 87–137 (Springer, 1960).

Tsur, Y. & Graham-Tomasi, T. The buffer value of groundwater with stochastic surface water supplies. J. Environ. Econ. Manag. 21, 201–224 (1991).

Brill, T. C. & Burness, H. S. Planning versus competitive rates of groundwater pumping. Water Resour. Res. 30, 1873–1880 (1994).

Provencher, B. & Burt, O. The externalities associated with the common property exploitation of groundwater. J. Environ. Econ. Manag. 24, 139–158 (1993).

Brozović, N., Sunding, D. L. & Zilberman, D. On the spatial nature of the groundwater pumping externality. Resour. Energy Econ. 32, 154–164 (2010).

Edwards, E. C. What lies beneath? Aquifer heterogeneity and the economics of groundwater management. J. Assoc. Environ. Resour. Econ. 3, 453–491 (2016).

Birkenbach, A. M., Kaczan, D. J. & Smith, M. D. Catch shares slow the race to fish. Nature 544, 223–226 (2017).

Ayres, A. B., Edwards, E. C. & Libecap, G. D. How transaction costs obstruct collective action: the case of California’s groundwater. J. Environ. Econ. Manag. 91, 46–65 (2018).

Costello, C. & Grainger, C. A. Property rights, regulatory capture, and exploitation of natural resources. J. Assoc. Environ. Resour. Econ. 5, 441–479 (2018).

Drysdale, K. M. & Hendricks, N. P. Adaptation to an irrigation water restriction imposed through local governance. J. Environ. Econ. Manag. 91, 150–165 (2018).

Hsueh, L. Quasi-experimental evidence on the ‘rights to fish:’ the effects of catch shares on fishermen’s days at sea. J. Assoc. Environ. Resour. Econ. 4, 407–445 (2017).

Barnett, T. P. et al. Human-induced changes in the hydrology of the western United States. Science 319, 1080–1083 (2008).

Medellín-Azuara, J. et al. Adaptability and adaptations of California’s water supply system to dry climate warming. Climatic Change 87, 75–90 (2008).

Ficklin, D. L., Null, S. E., Abatzoglou, J. T., Novick, K. A. & Myers, D. T. Hydrological intensification will increase the complexity of water resource management. Earths Future 10, e2021EF002487 (2022).

Albano, C. M. et al. A multidataset assessment of climatic drivers and uncertainties of recent trends in evaporative demand across the continental United States. J. Hydrometeorol. 23, 505–519 (2022).

Edwards, E. C., Cristi, O., Edwards, G. & Libecap, G. D. An illiquid market in the desert: estimating the cost of water trade restrictions in northern Chile. Environ. Dev. Econ. 23, 615–634 (2018).

Hanak, E., Sencan, G. & Ayres, A. California’s Water Market: Fact Sheet (Public Policy Institute of California, 2021).

Hughes, N., Gupta, M., Whittle, L. & Westwood, T. An economic model of spatial and temporal water trade in the Australian Southern Murray-Darling Basin. Water Resour. Res. 59, e2022WR032559 (2023).

Grafton, R. Q., Libecap, G., McGlennon, S., Landry, C. & O’Brien, B. An integrated assessment of water markets: a cross-country comparison. Rev. Environ. Econ. Policy 5, 219–239 (2011).

Pannell, D. & Rogers, A. Agriculture and the environment: policy approaches in Australia and New Zealand. Rev. Environ. Econ. Policy 16, 126–145 (2022).

Zheng, H., Liu, Y. & Zhao, J. Understanding water rights and water trading systems in China: a systematic framework. Water Secur. 13, 100094 (2021).

Regnacq, C., Dinar, A. & Hanak, E. The gravity of water: water trade frictions in California. Am. J. Agric. Econ. 98, 1273–1294 (2016).

Siirila-Woodburn, E. R. et al. A low-to-no snow future and its impacts on water resources in the western United States. Nat. Rev. Earth Environ. 2, 800–819 (2021).

Bjornlund, H. Farmer participation in markets for temporary and permanent water in southeastern Australia. Agric. Water Manag. 63, 57–76 (2003).

Hanak, E. & Stryjewski, E. California’s Water Market, By the Numbers: Update 2012 (Public Policy Institute of California, 2012).

Womble, P. & Hanemann, W. M. Water markets, water courts, and transaction costs in Colorado. Water Resour. Res. 56, e2019WR025507 (2020).

Loch, A., Wheeler, S. A. & Settre, C. Private transaction costs of water trade in the Murray–Darling Basin. Ecol. Econ. 146, 560–573 (2018).

Thompson, B. in A Research Agenda for Water Law (eds Casado Pérez, V. & Larson, R.) 237–266 (Edward Elgar Publishing, 2023).

Ayres, A. et al. Improving California’s Water Market: How Water Trading and Banking can Support Groundwater Management (Public Policy Institute of California, 2021); https://www.ppic.org/publication/improving-californias-water-market

Ge, M., Akhundjanov, S., Oladi, R. & Edwards, E. C. Left in the dust? Pecuniary and environmental externalities in water markets. SSRN https://doi.org/10.2139/ssrn.4596591 (2023).

Ayres, A., Adams, T., Carron, J., Cohen, M. & Saracino, A. Potential impacts of reduced inflows to the Salton Sea: forecasting non-market damages. J. Am. Water Resour. Assoc. 58, 1128–1148 (2022).

Rosegrant, M. W. & Ringler, C. Impact on food security and rural development of transferring water out of agriculture. Water Policy 1, 567–586 (2000).

Hanak, E. Who Should be Allowed to Sell Water in California? Third-Party Issues and the Water Market (Public Policy Institute of California, 2003).

Libecap, G. D. Institutional path dependence in climate adaptation: Coman’s ‘some unsettled problems of irrigation’. Am. Econ. Rev. 101, 64–80 (2011).

Wheeler, S. A., Zuo, A. & Kandulu, J. What water are we really pumping? The nature and extent of surface and groundwater substitutability in Australia and implications for water management policies. Appl. Econ. Perspect. Policy 43, 1550–1570 (2021).

Fowlie, M. L. & Reguant, M. Mitigating emissions leakage in incomplete carbon markets. J. Assoc. Environ. Resour. Econ. 9, 307–343 (2022).

Bigelow, D. P., Chaudhry, A. M., Ifft, J. & Wallander, S. Agricultural water trading restrictions and drought resilience. Land Econ. 95, 473–493 (2019).

Meng, K. & Thivierge, V. Do environmental markets improve allocative efficiency? Evidence from U.S. air pollution. https://vthivierge.github.io/files/efficiency.pdf (2022).

Ross, A. Speeding the transition towards integrated groundwater and surface water management in Australia. J. Hydrol. 567, e1–e10 (2018).

Gao, L., Connor, J., Doble, R., Ali, R. & McFarlane, D. Opportunity for peri-urban perth groundwater trade. J. Hydrol. 496, 89–99 (2013).

Kuwayama, Y. & Brozović, N. The regulation of a spatially heterogeneous externality: tradable groundwater permits to protect streams. J. Environ. Econ. Manag. 66, 364–382 (2013).

Palazzo, A. & Brozović, N. The role of groundwater trading in spatial water management. Agric. Water Manag. 145, 50–60 (2014).

Guilfoos, T., Khanna, N. & Peterson, J. M. Efficiency of viable groundwater management policies. Land Econ. 92, 618–640 (2016).

Bruno, E. M. & Sexton, R. J. The gains from agricultural groundwater trade and the potential for market power: theory and application. Am. J. Agric. Econ. 102, 884–910 (2020).

Bruno, E. M. & Jessoe, K. Missing markets: evidence on agricultural groundwater demand from volumetric pricing. J. Public Econ. 196, 104374 (2021).

Fishman, R., Lall, U., Modi, V. & Parekh, N. Can electricity pricing save india’s groundwater? Field evidence from a novel policy mechanism in Gujarat. J. Assoc. Environ. Resour. Econ. 3, 819–855 (2016).

Smith, S. M., Andersson, K., Cody, K. C., Cox, M. & Ficklin, D. Responding to a groundwater crisis: the effects of self-imposed economic incentives. J. Assoc. Environ. Resour. Econ. 4, 985–1023 (2017).

Bruno, E. M., Jessoe, K. K. & Hanemann, M. The dynamic impacts of pricing groundwater. J. Assoc. Environ. Resour. Econ. https://doi.org/10.1086/728988 (2023).

Chakravorty, U., Dar, M. H. & Emerick, K. Inefficient water pricing and incentives for conservation. Am. Econ. J. Appl. Econ. 15, 319–50 (2023).

California’s Cap and Trade Program Step by Step (Environmental Defense Fund, 2020).

Mieno, T. & Brozović, N. Price elasticity of groundwater demand: attenuation and amplification bias due to incomplete information. Am. J. Agric. Econ. 99, 401–426 (2017).

Grafton, R. Q. & Wheeler, S. A. Economics of water recovery in the Murray-Darling Basin, Australia. Annu. Rev. Resour. Econ. 10, 487–510 (2018).

Holland, S. P. & Yates, A. J. Optimal trading ratios for pollution permit markets. J. Public Econ. 125, 16–27 (2015).

Tietenberg, T. H. Transferable discharge permits and the control of stationary source air pollution: a survey and synthesis. Land Econ. 56, 391–416 (1980).

Fisher-Vanden, K. & Olmstead, S. Moving pollution trading from air to water: potential, problems, and prognosis. J. Econ. Perspect. 27, 147–172 (2013).

Bruno, E. M., Hagerty, N. & Wardle, A. R. in American Agriculture, Water Resources, and Climate Change (eds Libecap, G. D. & Dinar, A.) 343–366 (Univ. Chicago Press, 2023).

Costello, C. & Grainger, C. A. Grandfathering with Anticipation (National Bureau of Economic Research, 2022).

Montgomery, W. D. Markets in licenses and efficient pollution control programs. J. Econ. Theory 5, 395–418 (1972).

Grafton, R. Q. & Williams, J. Rent-seeking behaviour and regulatory capture in the Murray–Darling Basin, Australia. Int. J. Water Resour. Dev. 36, 484–504 (2020).

Goulder, L. H. & Parry, I. W. Instrument choice in environmental policy. Rev. Environ. Econ. Policy 2, 152–174 (2008).

Ryan, N. & Sudarshan, A. Rationing the commons. J. Polit. Econ. 130, 210–257 (2022).

Hearne, R. & Donoso, G. in Water Markets for the 21st Century: What Have We Learned? Global Issues in Water Policy Vol. 11 (eds Easter, K. W. & Huang, Q.) 103–126 (Springer, 2014).

Hartwig, L. D., Jackson, S. & Osborne, N. Trends in Aboriginal water ownership in New South Wales, Australia: the continuities between colonial and neoliberal forms of dispossession. Land Use Policy 99, 104869 (2020).

Arellano-Gonzalez, J. et al. The adaptive benefits of agricultural water markets in California. Environ. Res. Lett. 16, 044036 (2021).

Rafey, W. Droughts, deluges, and (river) diversions: valuing market-based water reallocation. Am. Econ. Rev. 113, 430–471 (2023).

Heard, S., Fienup, M. & Remson, E. et al. The first SGMA groundwater market is trading: the importance of good design and the risks of getting it wrong. Calif. Agric. 75, 50–56 (2021).

Kroetz, K., Sanchirico, J. N. & Lew, D. K. Efficiency costs of social objectives in tradable permit programs. J. Assoc. Environ. Resour. Econ. 2, 339–366 (2015).

Sutherland, S. A. & Edwards, E. C. The impact of property rights to fish on remote communities in alaska. Land Econ. 98, 239–253 (2022).

Gassert, F., Luck, M. & Landis, M. Aqueduct Water Stress Projections: Decadal Projections of Water Supply and Demand Using CMIP5 GCMs (World Resources Institute, 2015).

Luo, T., Young, R. S. & Reig, P. Aqueduct Projected Water Stress Country Rankings (World Resources Institute, 2015); https://www.wri.org/data/aqueduct-projected-water-stress-country-rankings

Brooks, R. & Harris, E. Efficiency gains from water markets: empirical analysis of Watermove in Australia. Agric. Water Manag. 95, 391–399 (2008).

Wheeler, S., Bjornlund, H., Shanahan, M. & Zuo, A. Price elasticity of water allocations demand in the Goulburn–Murray Irrigation District. Aust. J. Agric. Resour. Econ. 52, 37–55 (2008).

Ayres, A. B., Meng, K. C. & Plantinga, A. J. Do environmental markets improve on open access? Evidence from California groundwater rights. J. Polit. Econ. 129, 2817–2860 (2021).

Acknowledgements

We thank L. Hackett, G. Schlauch, A. Wardle and E. Wiseman for helpful comments and research assistance. This work was supported in part by Agriculture and Food Research Initiative Competitive grant numbers 2021-69012-35916 and 2021-68012-35914 from the USDA National Institute of Food and Agriculture.

Author information

Authors and Affiliations

Contributions

E.M.B. and K.J. contributed equally to all aspects of the paper. They jointly conceived, outlined, developed, wrote and revised the paper.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Climate Change thanks Eric Edwards and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bruno, E.M., Jessoe, K. Designing water markets for climate change adaptation. Nat. Clim. Chang. 14, 331–339 (2024). https://doi.org/10.1038/s41558-024-01964-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41558-024-01964-w